Brief Introduction About Cross Collateralization Cross Default Agreement

A cross collateralization and cross default agreement is signed between a lender and a borrower. This agreement is valid if a borrower has more than one type of loans with the same bank. Each of those loans should be secured with a collateral. In such case, this agreement can be drafted to ensure that both the loans are protected from any possible default by the buyer.

Why Do You Need a Cross Collateralization Cross Default Agreement?

Lenders need to be assured of repayment for their loans. When a person has two loans from the same financial institution, there is a higher risk of default. Such default in the payment by the buyer constitutes a default under the loan agreement itself. In that case, the lender is entitled to use the remedies mentioned in the loan agreement. One of those remedies is to use the secured collateral documents to ensure repayment of the defaulted loan — made under a cross default clause loan agreement.

This cross default and cross collateralization agreement is required so that the borrower and the lender agree that the collateral offered is the collateral for the entire loan. Any default under any deed of trust or loan will act as a default of all deeds of trust or loans.

Inclusions in the Cross Collateralization Cross Default Agreement

A standard cross collateralization cross default agreement template contains the following terms

- Recitals and definitions along with identification of the parties to the contract.

- Acknowledgment of

- Contribution for Cross collateralization within the pool

- Waivers by the borrowers from each of pools 1 and 2

- Contribution of cross collateralization across pools

- Release of cross collateralization

- Adjustment of loans and their modification

- Terms definition within the act

- Events that constitute default

- Governing law

- Successors and assignees

- Provisions and conditions upon which such provisions become inapplicable

- Counterparts

- Costs and Expenses

- The amounts of the loan

- The description of loans

- The collateral offered including identifying the collateral

- The period of the loan

How to Draft the Cross Collateralization Cross Default Agreement?

When drafting a cross collateralization cross default agreements, some points that need to be kept in mind are

- How the borrower would be divided into pools

- How the securities would be valued

- What acknowledgements and certifications will the borrower give to prove that the value of securities is higher than the loan taken

- Acknowledgement from the borrower that cross collateralization is not fraudulent

- The relation between the funding borrower and other pool 2 borrowers in case of a default with the pool 1 borrower and its definition in the cross collateralization agreement

- The extent of security that the loans shall act as collateral for.

- Modification of loans and the process for such modification

Benefits of Cross Collateralization Cross Default Agreement

Some benefits of this agreement are

- It protects the interests of the lenders

- It discourages buyers against defaults

- It increases the lender’s favorability in terms of lending to the borrower

- The borrowers also can borrow more because of the cross collateralization

- It reduces the burden of collection in case of a default

- It reduces the costs involved in remedying any defaults that happened with one loan

- Each pool of buyers is hedged from funding for the default of the other pool of buyers

- The funding borrower can get his costs reimbursed from the other members of the same pool

- The borrower’s rights do not get compromised.

Types of Cross Collateralization Cross Default Agreement

A typical cross collateralization cross default agreement is usually known to compose of two sections:

- The cross collateralization section

- The cross default section

Both the sections are vital to defining the terms & conditions of the contract while laying out grounds for following the principles as stated in the contract.

Clauses in Cross Collateralization Cross Default Agreement

Some key terms in this agreement are

- Acknowledgments from both pools about their coordination with the other

- Contributions within and across pools of borrowers

- Release of cross-collateralization

- Adjustment of loans and its modifications

- Events when provisions become inapplicable

What Happens in Case of a Violation?

In case of a default, the clauses for curing the default lies with the other pool of borrowers. The clauses contain relevant provisions for determining the extent of contribution by each pool. In simpler words, the collateral for the other loan would be used to reimburse this loan as well after due notices have been sent. Since most collaterals are more than the value of the loan, lenders’ NPAs can decrease.

A cross collateralization poses greater for the buyer and higher pressure to repay the loan. However, if done properly, both parties can benefit from it because of the security offered in the loan.

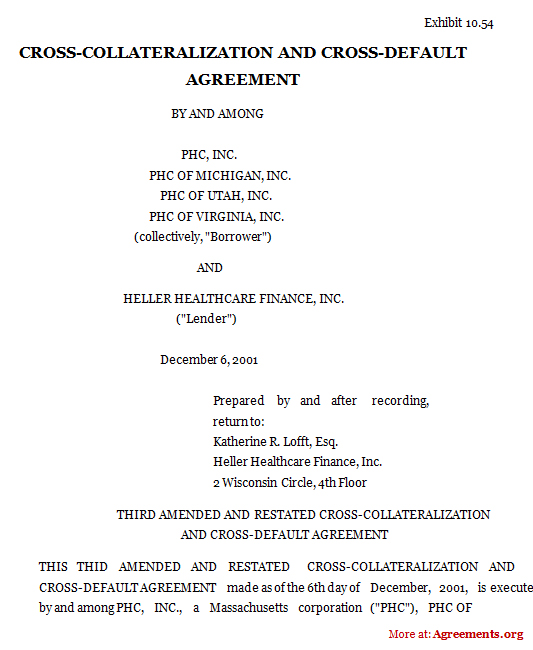

Sample for Cross Collateralization Cross Default Agreement

A sample of the agreement can be downloaded from below.