What Is the Cross Collateralization Agreement?

Whenever you want to use your collateral of one loan for taking another loan, then it comes under an agreement and is termed as a cross collateralization agreement. If you want to get a home loan and vehicle loan from the same institution, then you will need this agreement.

When Do You Need a Cross Collateralization Agreement?

If you have taken a loan for your car from a bank and you are also interested in taking a loan for your house, then your home and cars are your cross-collaterals for your loans. Imagine that you are planning to sell your house without repaying the loan of the car, then the bank has the right to veto that deal.

Inclusions in Cross Collateralization Agreement

The borrowers’ information is added with the lender’s amount given for the loan. First of all, recitals are added to this agreement, and then the major obligations are added to the second party. There is also a section for illegality and invalidity aspects of the terms added in the agreement.

How to Draft a Cross Collateralization Agreement?

It isn’t difficult to draft the cross-collateralization agreement as you just need to add the major key terms, inclusions, and clauses carefully. Both parties should agree on the terms and conditions added to the agreement. Both parties can hire a lawyer who will work without any bias towards the agreement formulation. Otherwise, you can also take the help of the templates to formulate the agreement.

Benefits of Cross Collateralization Agreement

This agreement allows the borrower to have the facilitation of taking loans from the same place, and the lender has reduced risk in such cases. If the borrower doesn’t pay the loan, then the bank can withdraw money from the account of that person and freeze the account. You can also get these loans from credit unions on low-interest rates. The lender becomes comfortable to do business with the lender due to this agreement. Before providing a loan, the credit score is checked by the borrower and required collateral. One has to pay down payment before getting a collateral loan for different assets. With the help of a single asset, the borrowers are able to get multiple loans.

Key Cross Collateralization Clauses in the Agreement

- Recitals

- Adjustment of loans

- Capitalized terms

- Governing law

- Successors and assigns

- Costs

- Inapplicable provisions

- Renewal and extension terms

- Partial liability release

What Happens in Case of Violation?

Are you going to sign the cross-collateralization agreement? If yes, then you should always check its violation code. There can also be risky penalties for not following your responsibilities and duties, as mentioned in the agreement. So, if you are going to sign such an agreement, you should read it carefully before signing it. You can also call your attorney, who can help you to avoid any issues regarding the wrongful addition of violation acts. Make sure that you don’t enter this agreement without learning all the risks and aspects of it.

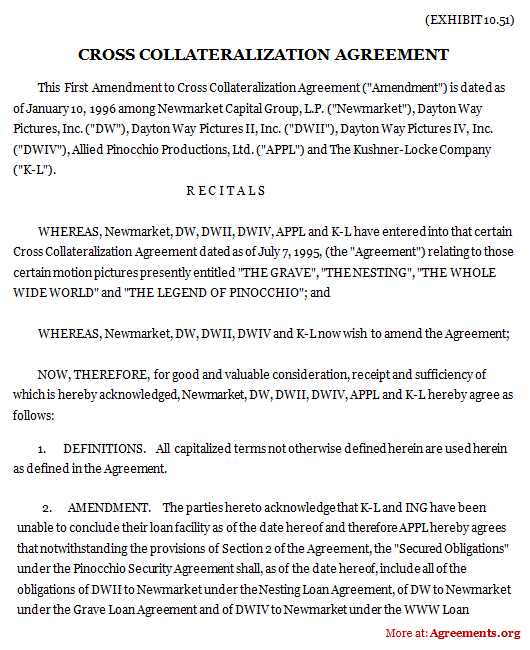

Sample for Cross Collateralization Agreement

A sample of the agreement can be downloaded from below.

Download this USA Attorney made original Agreement for only $9.99

By clicking the button below, I agree with the Terms & Conditions.