A cross collateralization agreement is one in which the same property is used for securing multiple loans from a financial institution or bank. The property can be immovable or movable according to the terms set by the bank. The cross collateralization agreement provides that the property will be secured under the bank’s control until all the loans due to the bank are not repaid by the borrower. The cross collateralization agreement comes to an end when the borrower has repaid all the loans due to the bank.

The contents of a cross collateralization agreement are details of property secured under the agreement, details of the borrower, date of loans issued, maturity date of the loans, market value of the properties that have been secured etc. The bank includes all the assets and loans of the borrower for the purpose of bringing it under one basket for better recovery of the loans offered to the borrower.

[Also Read: Cross-collateralization Cross-default Agreement]

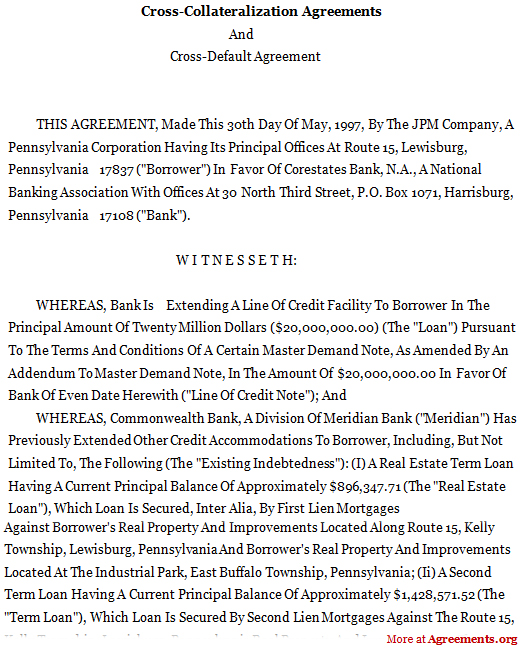

Sample for Cross-Collateralization Agreement

A sample of the agreement can be downloaded from below.

Download this USA Agreement of Limited Partnership for only $9.99

By clicking the button below, I agree with the Terms & Conditions.