What Is Credit Facility Agreement?

Credit facility agreement or a loan agreement letter is a contract or letter according to which a lender (usually a bank or other financial institution) sets out the terms and conditions based on which it is prepared to make a loan facility available to a borrower.

It is often used in a business or corporate setting. As per the credit facility definition, it is entered into between a borrower and a lender for providing credit. A lender may be an individual, a financial institution, or a banking consortium. A credit facility agreement letter guarantees the company funds for its working capital.

When Do You Need Credit Facility Agreement?

A bank credit facility agreement is required when companies need funds either for working capital requirements or for other short term funds. These funds may not be needed immediately but over a period of time. In that case, companies sign a buyer credit facility agreement where they can withdraw funds as needed over a period of time. When a company needs to recapitalize their assets or free up cash for expanding, they enter into this agreement. A credit facility agreement definition gives us an insight into the use the company would have of the loan.

Inclusions in Credit Facility Agreement

A standard credit facility agreement template contains clauses that outline who is taking the loan and the purpose they are taking the loan for. Some of the clauses in the agreement are

- The details of the person who is taking the loan including names, addresses and contact details

- Definitions of the terms and the scope of the agreement

- The nature of the service including its purpose

- Repayment schedule, payment amount, calculation of interest or other fees and modes of payment

- Provisions relating to costs, fees and other payment obligations

- Representations and warranties

- Undertakings (also known as covenants)

- Events of default

- If additional credit support is required from related third parties, a guarantee on facilities with more than one lender, provisions for coordinating between lenders

In some cases, companies may get a steady stream of credit called revolving credit. This happens until the agreed threshold is reached. A revolving credit facility agreement sample would include the threshold limits, which also serves as a point of negotiation for the companies to ensure that their credit is enough for their requirements

How to Draft Credit Facility Agreement?

When drafting an agreement, there are some points that need to be considered

- The facility agreement will contain provisions relating to the applicable interest rate(s), as well as how and when interest payments are to be made

- The purpose of issuing credit and provisions that deal with contravention of such purposes

- Tax liability on the credit facility used

- Changes in costs for providing service and permissibility of changes in the contract

- Miscellaneous terms including guarantees, warranties, indemnification and other boilerplate clauses

- Details of termination and any penalties the parties might include as a levy.

What Are the Key Benefits of Credit Facility?

The standard loan condition to this agreement includes many benefits. Along with flexible loans facility. The credit facility offers a lot of benefits to the company and the lender. Some of them are

- It provides flexibility on when the capital can be used by the company. This way, funds won’t be left idle nor will they be blocked for use

- Because the rate of interest remains within a framework, companies can be assured of paying a fixed amount for the flexibility banks offer.

- When capital is required, companies have instant access to it without suffering any delays.

- The borrower has the discretionary powers to ladder debt maturities

- A credit facility provides resources for expansion. Because of the duration of the facility, properties may be substituted in the pool of assets offered as collateral.

- Lenders get a steady payment adjusted according to the time-changing value of money.

Disadvantages only come in when companies fail to repay part of the credit that it has borrowed. Not only will it affect the contract and banking relations, but it can affect their credit score. The lender will receive steady payments for the value of service provided. There is a chance that the present value of payments received may be lower than the present value of money provided.

What Are the Terms of a Credit Facility Agreement?

- Parties should define the terms in the engagement letter clearly. This prevents any confusion and differences in interpretation of the fine print in the contract.

- So, in this agreement, parties should define the start and end of the term of the credit facility clearly so that the time for which the service is provided is not vague.

- Most credit facilities often run for a fixed period of time- say, six months or two years, after which you can decide whether you wish to renew it. Though the terms could vary, there’s always a maximum facility limit and payment terms that specify when you need to make repayments for the money you’ve drawn down.

- The agreement details the borrower’s responsibilities, specify the date when the loan matures,

- It must have the interest rate, the date for repayment, default penalties and any other terms and conditions.

- When lenders provide a credit limit, they should mention some terms regarding the limits including, if applicable, the credit score, bank policies and the reason for providing the limits. Along with that, the bank’s policies for offering the credit and penalties for overdrawing should be mentioned.

What Happens in Case of Violation?

Breach of contract may result in immediate termination of the contract. Any amount is withdrawn but unpaid would be recovered by filing a suit in the court of law. If the parties have arbitration clauses, then they may resort to that. Compensatory damages may be awarded if the breach of contract has caused substantial loss to the injured party. An immediate freeze on the credit facility would be levied and prolonged non-payment of dues may be cleared by sale of the collateral assets.

This agreement is a helpful and reliable tool for managing a wide array of assets. Many companies opt to use this service as it contains flexible financing options that are attractive to large scale Borrowers.

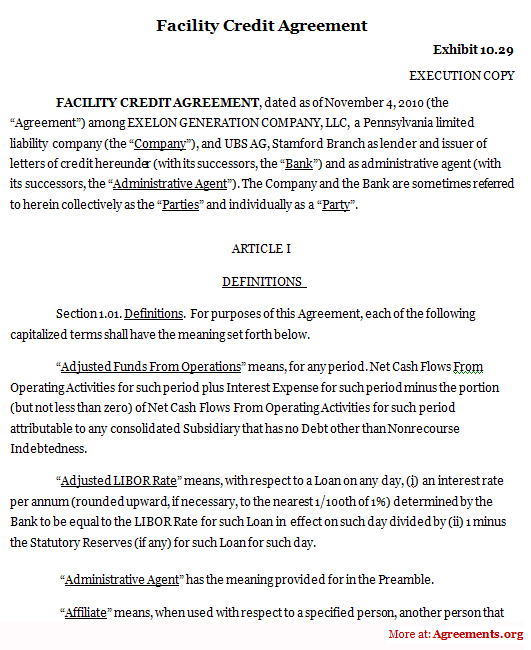

Sample for Credit Facility Agreement

A sample of the agreement can be downloaded from below.

Download this USA Attorney made original Agreement for only $9.99

By clicking the button below, I agree with the Terms & Conditions.