What Is a Corporate Governance Agreement?

Corporate Governance is a set of rules, laws, and processes by which businesses or organizations are operated, regulated or controlled. A Corporate Governance Agreement is entered between the company and its stockholders to agree upon a binding Corporate Governance Framework. A well-drafted agreement aligns the business conduct with the objectives of the organization, without being too onerous on either party to the contract.

When Do You Need a Corporate Governance Agreement?

While having a Corporate Governance Plan is beneficial for all organizations, this agreement is imperative in the case of larger companies, especially public companies. Since public companies entail a well-formed and cross-connected network between the company’s shareholders, customers, suppliers, government regulators, and management, they require a binding governance structure for smooth functioning.

Principles of Corporate Governance help bring about a well-defined and enforced structure in place that works for the benefit of everyone concerned by ensuring that the enterprise adheres to accepted ethical standards, best practices, and formal laws. Since the agreement is legal and binding in nature, stakeholders who deviate from the agreement can also be held liable for damages/fines.

What Should Be Included in a Corporate Governance Agreement?

The agreement should include basic corporate governance principles and mitigate to standard organizational issues. It should adhere to the standards to the corporate governance law and lay down a transparent set of rules and controls in which shareholders, directors, and officers have aligned incentives. A corporate governance agreement template would contain the following provisions

- A code that ensures accountability of the company’s Board of Directors as well as all shareholders in accordance with applicable law

- Guidelines for the Board of Directors in making decisions and monitoring the activities of the executive bodies

- Representation and warranties of the shareholders and the company

- Remedies and redressal measures to be followed in case of violations of shareholder’s rights

- Conflict management process

- Definition of the various terms used in the contract

- Standstill provisions for

- Acquiring or selling securities

- Business transactions on behalf of the company

- Proposal for mergers and acquisitions

- Forming cliques with respect to securities

- Making public announcements

- Take any action which might force the company to act

- Enter into or form any committees

- The exceptions for standstill provisions

- Transfer restrictions on securities

- Representations and Warranties of the company

- Representations and warranties of the shareholders

- Amendment and Waivers to the contract

- Successors and assignments to the contract

- Governing Laws

- Jurisdiction and selection of Forum

- Counterparts to the agreement

- Specific performance parts of the agreement

- Severability provisions of the agreement

- Public announcements, voting provisions

- Changes and notices

- Procedure for disbursement of return on Investment

- Process for disclosure of information about all material facts relating to the company’s activities, including its financial position, social and environmental indicators, performance, ownership structure, and governance.

- Miscellaneous provisions, if any.

How to Draft a Corporate Governance Agreement?

This agreement aims at creating a binding code of conduct for the board of directors, stakeholders and capital investors of a company. While the form of a Corporate Governance Agreement may vary from organization to organization, it should be drafted, keeping in mind four key principles:

- Accountability

- Responsibility

- Fairness

- Transparency

The agreement should lay down the responsibilities of each of the parties in a fair and transparent manner. It should provide an equitable code of conduct and safeguard the interests of both the company and its investors. Some points that need to be considered when drafting a company governance agreement are

- What provisions would standstill clause apply for

- What suggestions would mandate setting up of committees

- How would cliques and shareholder suggestions be dealt with

- For what provisions do shareholders have absolute discretion rights as the shareholders of the company

- Restrictions on transfer of securities considering fairness and company interests in mind

- What events would warrant public announcements by the company

- Boilerplate clauses and counterparts

Benefits of a Corporate Governance Agreement – Pros and Cons

Some advantages of the agreement are

- The agreement is a written directive for how a company’s board of directors is composed and how it operates.

- It brings about transparency and fairness in the day to day operations of the company and helps in bringing about trust from the investor’s part.

- Since the agreement is in writing, it comprises an established set of rules that bind both the board of directors as well as the shareholders in the matters of business conduct and organizational behavior.

Some drawbacks of the agreement are

- The absence of an agreement could lead to bad governance

- Corporate governance issues and problems could cast doubt on the company’s reputation and integrity and can also have financial implications for the company in the long run.

- Not having this agreement in place could also lead to mismanagement and leniency on the part of the Company’s board.

- This can hamper investor relations and cause business losses in extreme circumstances.

Key Terms/ Clauses of a Corporate Governance Agreement

Corporate Governance definition is just a general legal and behavioral code of conduct for the company and its managers. The agreement should contain few specific clauses. A good governance agreement lays out the procedure of decision making with transparency and holds the company’s board responsible for fair planning and management. The agreement should also enumerate upon the role of a managing partner and other key decision-makers of an organization and lay down a strong foundation for the smooth operation and management of a company. Some key terms of the agreement are

- Standstill provisions and their exceptions

- Restrictions on the transfers

- Events that would constitute a need for

- Public announcements

- Notices to shareholders

- Creation of independent committees

- Addressing shareholder queries

- Setting up transparency bodies for shareholder communications

A Corporate Governance Agreement is at the core of managing an organization. It is an effective method through which the company manages to prevent any sort of mismanagement in terms of investments and routine operations. A well-drafted agreement provides policies and rules for transparently managing a corporation.

[Also Read: Corporate Governance Charter Agreement]

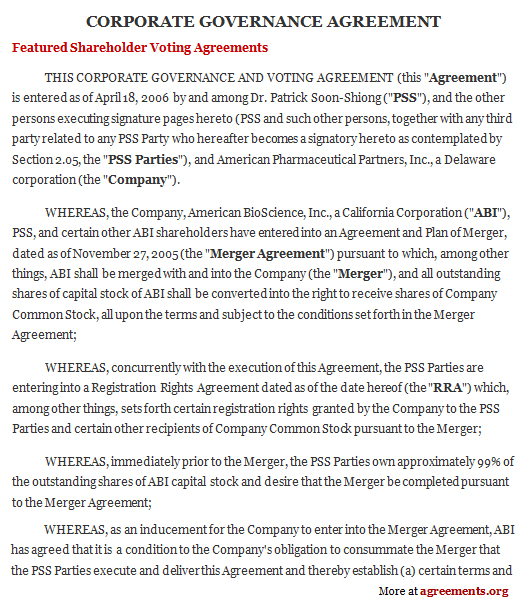

Sample Corporate Governance Agreement

Click here to download a sample Corporate Governance Agreement in PDF/DOC.