A convertible note agreement is for an investor to subscribe to a convertible note. This is a debt instrument that will be converted into an equity instrument. This conversion may be upon the happening of a certain liquidity event or upon the maturity of the note. For raising funds, companies may use this agreement if a few investors are subscribing. Unlike a simple converted instrument, this convertible still bears interest. It has a minimum amount of funds that can be raised at the financing event.

What Is the Convertible Note Agreement?

A convertible note is known as a short term debt that can be converted into equity considering the financial round in the future. It is used as an agreement between a company that wants to raise funds and the investor that wants to subscribe to the convertible note. It provides a means to the investor to get the money for a start-up rather than returning the same in the form of the principal amount plus interest.

Who Takes a Convertible Note Agreement?

A Equity Conversion Note Agreement is made between an investor and a company. Generally, it is taken by the investor for the protection of his financial interest and the company to raise funds from a select investors band

What Is the Purpose of a Convertible Note Agreement?

A convertible note agreement helps the company in raising funds easily. By converting debt instruments into equity instruments, the company does not have to pay heavy interests. Because of the discounts offered, it can get more subscription

Contents of a Convertible Note Agreement

A standard convertible note template includes

- Name and address of the parties involved

- Duration of the Agreement

- Purchase and Sale of Notes

- Type of stock – preferred or secured convertible notes

- Shareholders meetings, communication, positive and negative covenants

- Date of the Agreement

- Documents required for conversion

- Representations and Warranties of the company

- Representations and Warranties of the purchaser

- Conditions of the company’s obligation at the time of closing

- Conditions of purchaser’s obligation at the time of closing

- Terms and conditions of termination of the agreement

- Remedies available in case of breach of agreement

- Renewal process if any

- Registration of the securities

- Covenants of the company and the purchaser

- Waiver of Rights

- First refusal of rights

- Severability of the contract

- Any notices

- Miscellaneous provisions

How to Draft a Convertible Note Agreement?

The process of drafting an agreement should be while keeping some points in mind. Any convertible note sample agreement would include the following terms

- The issue of the notes

- The type of stock that would be issued

- Sale and purchase of stock and notes

- The names of the investors on its record

- There are no restrictions on the company that prohibit it from entering into such agreements.

- There are no liens or charges on the capital stock

- There are no outstanding options or rights to purchase stock

- Representations and warranties by the noteholders

- Prepayment of notes

- Conversion

- Covenants

- Details of the company’s obligation at the time of closing

- Details of purchaser’s obligation at the time of closing

- Details of Terms and conditions of termination of the agreement

- Details of Remedies for Breach of agreement

- Details of Renewal process if any

The negotiation process of any agreement depends on the choices of the parties involved in an agreement- whether they want to do it individually or appoint a third party or attorney to do the work for them.

Benefits and Drawbacks of a Convertible Note Agreement

The primary advantage for the issuance of a Equity Conversion Note Agreement is that it does not allow the investors as well as the investors for the determination of the value of the company and when the company may actually not be much interested in a valuation base. In most of the cases, the company must have an idea for the same. The aforesaid valuation can easily be determined with these financing schemes mentioned in the agreement. Apart from that, it helps the investor to secure his financial interests.

This agreement is one such document that protects the rights of the company as well as the investor. In that way, the legal rights and obligations of the parties are protected. This helps establish a formal relationship between the maintenance of providing company and investors. One of the basic drawbacks of the aforesaid agreement is that sometimes it may not be beneficial for the company as it is only focusing on the financial interest of the investor rather than focusing on the earned profit for the company.

What Happens in Case of Violation?

In case of violation of the Equity Conversion Note Agreement by either of the parties involved, it calls for a breach of contract. The agreement provides the remedies for breach, that helps the parties to settle the dispute accordingly.

The need for legal documentation is an essential part in any business dealing. Thus, this agreement is one such document that protects the rights of the company as well as the investor. In that way, the legal rights and obligations of the parties are protected. The agreement establishes a formal relationship between the providing company and investors.

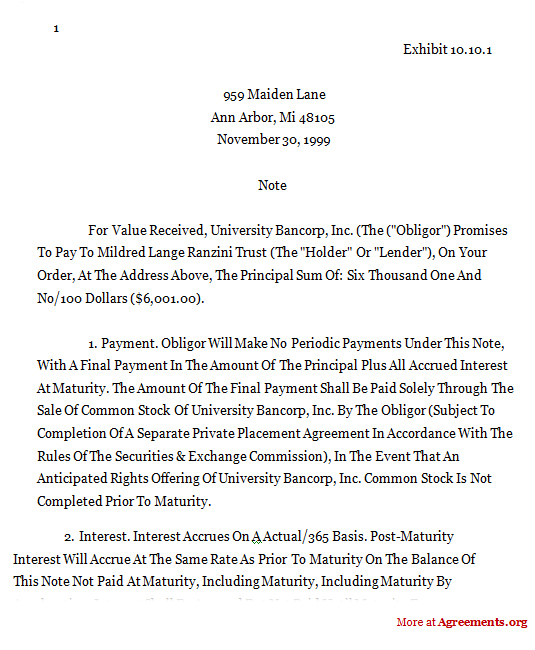

Sample for Equity Conversion Note Agreement

A sample of the agreement can be downloaded from below.

Download this USA Agreement of Limited Partnership for only $9.99

By clicking the button below, I agree with the Terms & Conditions.