What Is a Convertible Loan Agreement?

Convertible loan agreements are complicated documents that are drafted for protecting the company and the investor.

A convertible loan is a short-term debt that converts into equity. Generally, it converts at the next investment round.

Convertible debt is a loan or debt obligation from an investor that is paid with equity or stocks in a corporation. Convertible debt is also recognized as convertible loans or convertible notes.

When a business borrows money from investors and plans to convert it to equity or ownership in the business at a later time, that is called convertible debt, the borrower, as well as the lender, decides the type of equity and a fixed time when the loan converts based on the business value when the loan begins.

When Do You Need a Convertible Loan Agreement?

Debt financing is when an investor loan funds towards the business with a set interest rate. An individual makes regular payments back to the investor at the settled rate until the loan reaches maturity.

What makes a loan convertible is what takes place after the loan gets matured. With a convertible loan, the investors could choose to convert the loan into shares or equity upon evaluation of the company.

Some loan agreements would convert into equity automatically, and others shall offer the choice to investors upon maturity of either receiving a lump sum or taking shares.

Purpose of the Convertible Loan Agreement

The main purpose of a convertible note is that it would convert into equity at some point in the future, in effect, the investor shall be loaning money to a startup and instead of a return in the form of principal plus interest, and the investor would receive equity in the business.

The key advantage of issuing convertible notes is that it doesn’t force the issuer and investors towards determining the value of the business when there really might not be much to base a valuation on – in a few cases, the business may just be an idea. That valuation would usually be determined during the Series A financing when there are additional data points off which to base a valuation.

Key Terms of a Convertible Loan Agreement

The major terms of a convertible loan agreement are;

Maturity date – This denotes the date on which the note is due, at which time the company needs to repay it. The duration of a convertible note could differ widely.

Interest Rate – A convertible loan agreement always has an interest rate as the primary issue of the agreements is ‘loan.’ Since you are lending money towards a business, convertible notes would more often than not accrue interest as well. Though, as opposed to being paid back in cash, this interest accrues towards the principal invested, increasing the number of shares issued on conversion.

Discount Rate – This signifies the valuation discount you have received relative to investors in the subsequent financing round, which compensates you for the extra risk you carry by investing earlier.

Valuation Cap – “Valuation Cap” is also recognized as “price cap” or “conversion cap,” which is the ceiling for the conversion price. The valuation cap is an added reward for investing early on. Additionally to the conversion discount, convertible notes also usually have a valuation cap, which is a hard cap on the conversion price for note-holders irrespective of the price per share on the next round of equity financing. Usually, any automatic conversions that happen at the maturity date (if no qualified financing has occurred) are at a certain price per share that is lower than the valuation cap.

Amendment and waiver provisions – An amendment and waiver provision is generally a part of the boilerplate language at the end of a convertible note. It permits for noteholders to hold up the terms of a new financing deal if they think that it is not favorable to their investment.

Inclusions in an Agreement

Parties involved: In making this agreement, there are usually two parties involved, the first being company, and the second is the investor.

Effective dates: This agreement would state the date when the agreement starts and when the agreement will expire, if applicable

How to Draft the Convertible Loan Agreement?

In drafting a convertible loan agreement, you must include the following key terms:

- Parties involved

- Security interest

- Redemption

- Interest

- Consent rights and minority protection

- Transferability

It will also include

- Conversion events

- Appropriate conversion feature

- Maturity Date, Interest Rate, and Prepayment

- Change of control premium

- Events of default

Benefits of a Convertible Loan Agreement

The benefit from the viewpoint of an entrepreneur is that a convertible loan before its conversion acts very much like a standard loan: the investor usually doesn’t have many of the rights of a preferential shareholder (board seats, liquidation preferences, etc.). As it is a fairly short and simple document, it also gets completed faster (that is why convertible loan investment could be processed faster than an equity investment).

Also, a standard convertible loan doesn’t need immediate payment of interest. Rather, it gets accrued and converted to equity.

Types of a Convertible Loan Agreement

It is correct that there is an extremely wide choice as to how convertible loans could be structured; there are few typical structures. These could be divided into three categories:

- A simple pre-money valuation conversion;

- A more complex pre-money formula-based conversion; and

- A discounted conversion.

What Happens In Case of Violation?

The events of Default convertible loan agreement includes; Failure to pay; Continuous breach of any other material representation or warranty, and Bankruptcy or insolvency. If such events happened, then the business can decide to discontinue (or does cease to conduct) commerce and breach or nonperformance of the responsibilities in the agreement. Default events permit the noteholder to order immediate repayment of any unpaid debt.

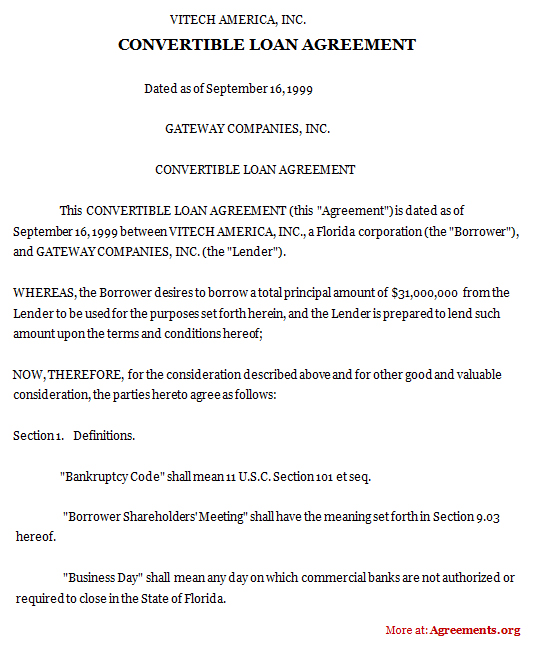

Sample for Convertible Loan Agreement

A sample of the Convertible Loan Agreement can be downloaded from below.

Download this USA Attorney made original Agreement for only $9.99

By clicking the button below, I agree with the Terms & Conditions.