Collateral is defined as a thing that is pledged to a lender to secure a loan. It is generally an item that has considerable value and can be used to recover the loan amount. If the loan is not repaid, the lender can sell the collateral and recover the money. However, if it is repaid, the collateral is returned to the borrower. It is mostly used by startups and small businesses who find it difficult to get unsecured loans. The type of collateral may range from stocks, bonds, the equipment being bought with the loan or items in the inventory.

What Is a Collateral Security Agreement?

A collateral security agreement, also known simply as a security agreement or collateral loan agreement, is a business agreement between the borrower and the lender. It transfers the rights of the borrower in the collateral to the lender as a security for repayment of the loan. Once it is repaid, the borrower gets back the assigned rights in the collateral. It is used along with a secured promissory note (a promissory note is a document between a borrower and a lender where the borrower promises to pay the loan amount to the lender after a certain time). A promissory note with collateral may include a reference to the original security agreement and a brief description of the collateral property.

Purpose of a Collateral Security Agreement?

It is used to lay down provisions that govern the lender’s rights in the collateral. It lists the transactions where the borrower may use the collateral in the ordinary course of business. It also prescribes requirements of giving notice to the lender if the borrower intends to take any action related to the collateral. It reduces the risks faced by the lenders by advancing the loan amount. It allows the parties to define the conditions under which the collateral can be used. This reduces the scope for disputes and lawsuits.

Key Terms of a Collateral Security Agreement?

Some of the key terms to be included are:

- Names and description of the parties

- The intention of the borrower to create an interest in the collateral

- Definitions of terms used in the agreement

- Description of the collateral

- Obligations of the borrower concerning the collateral

- Representations and warranties by the borrower

- Events of default

- Governing law of the respective state to apply to the agreement

- Requirements of notice

- Signature of both the parties along with the date

Drafting a Collateral Security Agreement?

The security interest in the United States of America is governed by Article 9 of the Uniform Commercial Code, which has been adopted in some form by almost all the states. Thus, the provisions of Article 9 are important to consider when drafting a collateral security agreement. Also, the following points must be kept in mind.

- Clearly, describe the collateral and state the intention to create a security interest in it. The description should include the type of collateral, its quantity, and other information specificity associated with it.

- Include a provision declaring that the collateral property is not used for meeting any obligations other than those intended in the agreement.

- Include provisions that put an obligation on the borrower to notify the lender if the property is damaged or its value decreases.

- Specify the events of default, apart from the failure of the borrower to repay the loan amount. These may include substantial damage to the collateral property, violation of other clauses of the agreement, or unapproved transactions carried out by the borrower.

Advantages and Disadvantages of a Collateral Security Agreement

Advantages:

- It provides a clear picture of the agreed terms between a borrower and a lender. Therefore, it reduces the chance of a dispute.

- It allows a small-scale borrower to raise large funds by assigning the collateral to the lender.

- It serves as evidence in court in case one party sues the other over breach of the agreement.

Disadvantages:

- The borrower may not have a high negotiating power and may have to agree to the lender’s terms.

- Once the conditions are put in writing and signed by the parties, the borrower cannot use the collateral in any other manner.

Types of Collateral Security Agreement

There are broad of two types:

- General agreement: Under this agreement, the borrower grants a security interest to the lender over all of the property that he presently holds as well the property he will acquire after the agreement.

- Chattel mortgage or equipment lease security agreement: Under such an agreement, the borrower grants a security interest to the lender only cover certain specific assets.

A related agreement is the collateral access agreement. When the borrower occupies a property as a tenant and the collateral is located on that property, the landlord and the lender may enter into a collateral access agreement. This agreement grants the lender the right to access the collateral that is located on the landlord’s property. It can also include an assurance on the landlord’s part that in case the tenant (borrower) fails to pay the loan, the collateral will be preserved. For example, if a tenant has taken a loan from a bank and pledged his car as collateral, the bank can enter into a collateral access agreement with the landlord to access the car that is in the premises of the landlord’s property.

What Happens When a Collateral Security Agreement Is Violated?

If one of the parties violates this agreement, it can be penalized under the terms agreed between the parties. While drafting the agreement, they can decide the quantum of damages to be paid by the defaulting party. In case of a dispute, the parties have to proceed as mentioned in the agreement. Usually, agreements of a commercial nature prefer arbitration as a mode of dispute settlement. If it is mentioned in the agreement, the parties can proceed to arbitration as per its terms. However, if it is not mentioned, the suffering party can sue the defaulting party in the local court for breach of contract.

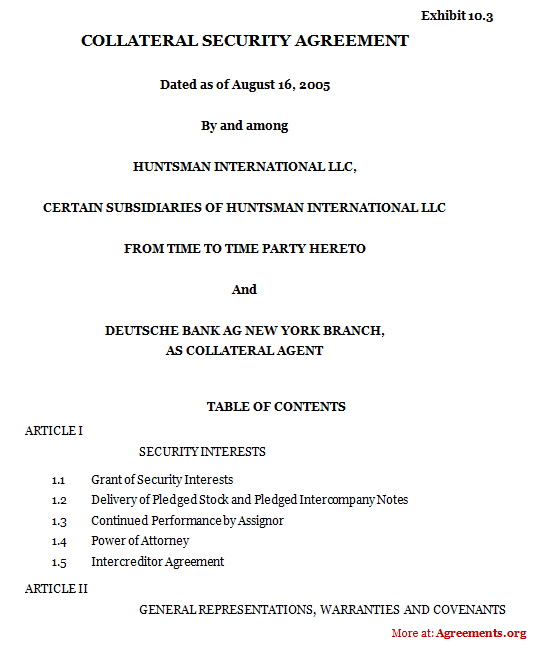

Sample for Collateral Security Agreement

A sample of the agreement can be downloaded from below.