When an individual or entity takes a collateral loan, they pledge an asset as security. The borrower can request the loan provider to use a custodian to keep the asset safe from fraud, loss or misuse. If the lender agrees to this request, they and the borrower will sign an extension of the collateral loan agreement known as collateral safekeeping agreement. Once the two parties sign the agreement, the borrower can get access to the collateral after getting written consent from the lender.

The safekeeping service provider evaluates the asset and determines its value. It is common to set a market value for the collateral and based on that, the lender provides the loan to the borrower.

When Do You Need Collateral Safekeeping Agreement

Usually, you need collateral safekeeping agreement when you secure a loan using an asset, like shares, non-negotiable CDs, bonds and LoCs. The agreement ensures that the security pledged cannot become an asset of the lender (the bank or financial institution), and the lender has to return the asset to the borrower when they request it. Typically, a third-party provides collateral safekeeping services for a fee.

Purpose of Collateral Safekeeping Agreement

The purpose of collateral safekeeping agreement is to ensure that compliance with the laws that govern securities and bonds pledged by borrowers and when there are limitations on the amount of deposits. The agreement ensures that when the collateral is worth more than the loan amount, it is safe from fraud, misuse and any other risky action.

Inclusions in Collateral Safekeeping Agreement

Some of the inclusions in collateral safekeeping agreement are as follows:

- Name and address of the lender

- Name and address of the borrower

- Name and address of the custodian

- Type of collateral

- Loan amount

- Duration of the loan tenure

- What would happen to the collateral should the borrower default

- The procedure the borrower needs to follow to get access to the collateral asset

- How would the collateral asset be returned to the borrower

How to Draft Collateral Safekeeping Agreement

Drafting a collateral safekeeping agreement requires care, as it involves high-value assets that the borrower keeps as collateral. It is essential that all terms and conditions get highlighted properly, so that there are no ambiguities.

- Borrower needs to request in writing about collateral safekeeping

- Agreement gets prepared once the lender acquiesces

- Mention the names and addresses of the lender and borrower

- State the type of collateral used to secure the loan

- Agreement should state that the lender agrees to the request

- Details of the collateral safekeeping agency

- Who will pay the agency for the safekeeping and the amount?

- Whether the borrower will have access to the assets. If yes, how?

- The tenure of the loan and the total loan amount

- How will the assets be returned to the borrower?

Both the lender and borrower have to sign the contract for it to be legal and binding.

Pros and Cons of Collateral Safekeeping Agreement

Here are the advantages of collateral safekeeping agreement:

- Reduced credit risk for the lender

- Collateral is safe with the custodian

- Chances of high appreciation of asset

- Borrower retains ownership of the asset

- Prevents fraud and misuse of collateral

Some disadvantages associated with collateral safekeeping agreement are:

- Restricted access to the collateral as borrower needs written consent from the lender

- Collateral is vulnerable in case of bankruptcy of the borrower

- Borrower may be liable to pay the custodian for collateral safekeeping

Types of Collateral Safekeeping Agreement

Types of collateral safekeeping agreement will depend on the kind of collateral that the borrower pledges. Besides the regular boilerplate clauses in the agreement, it will mention the details of the collateral, loan amount and tenure. In addition, the agreement will state whether the borrower can withdraw part or all of the collateral after getting written consent from the lender.

Key Terms / Clauses in Collateral Safekeeping Agreement

Some of the key terms of collateral safekeeping agreement are:

- Pledged Asset: The asset that is used as collateral

- Principal and Income Payments: Refers to the income and other payments that the collateral earns

- Account Statement: The monthly statement of account that the custodian sends to the borrower regarding the performance of their asset if it earns income or interest

- Valuation Reporting: The value of the asset as evaluated by the custodian agency

- Applicable Laws, Rules and Regulations: Custodian has to conform to the prevailing rules, laws and regulations of reporting details about the asset to IRS or any other governmental authority if needed

- Privacy: The lender and custodian ensure that the borrower’s non-public information stays private

- Force Majeure: The custodian is not liable for act of God, strike, terrorism, war, or any other situation beyond the control of the custodian

What Happens When You Violate Collateral Safekeeping Agreement

If you violate the terms of the collateral safekeeping agreement, the lender can go to court to sequester the collateral or foreclose the loan by exercising the power of sale to sell the asset and recover their dues.

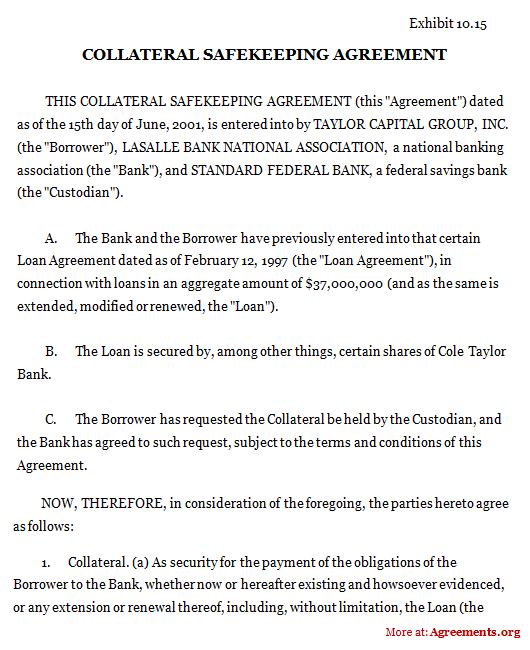

Sample Collateral Safekeeping Agreement

As collateral safekeeping agreement details with valuable assets pledged as security, it is essential that the agreement contains all necessary details. To understand the inclusions and legal terminologies that go into making the agreement, you can download a sample here.

Download this USA Attorney made original Agreement for only $9.99

By clicking the button below, I agree with the Terms & Conditions.