What Is a Collateral Assignment Agreement?

A collateral assignment agreement is an agreement made between an individual and his life insurance provider. This agreement allows the death benefit of an individual’s life insurance policy, which is to be used as collateral to secure a loan.

When a borrower applies for a Small Business Administration (SBA) loan, lenders usually require borrowers to utilize life insurance coverage as collateral for the loan. This is known as a collateral assignment. Collateral assignment makes certain that the lender shall be paid any outstanding loan amount in the event of the borrower’s death.

This agreement is drafted in a policy form, given by the life insurance corporation, and must be signed by parties involved. Collateral assignment makes certain that the lender is paid any outstanding loan amount if the borrower dies. This agreement allows the death benefit of an individual’s life insurance policy and can be used as collateral to secure a loan. The borrower must name their beneficiaries, where the rest of the sum shall go to the mentioned beneficiaries.

When Do You Need a Collateral Assignment Agreement?

A collateral assignment of life insurance is defined as a conditional assignment rendering a lender as the chief beneficiary of death benefits towards being used as collateral for a loan.

When the borrower is not able to pay the loan, the lender could cash in the life insurance policy and recover the outstanding due.

Purpose of a Collateral Assignment Agreement

Collateral Assignment of a life insurance policy is generally conditional. For a lender, a life insurance policy gives extra security to the bank’s investment.

Simultaneously, it lets business owners grow and develop their business through the form of a bank or small business loan.

Many banks accept life insurance as a form of collateral because life insurance policies pay in a lump sum, and it provides a sense of security that their loan would be paid, in case the borrower passes away.

Key Terms of a Collateral Assignment Agreement

When a borrower is applying for life insurance for collateral assignment, the borrower is required to name the beneficiaries as he would for a personal policy.

The lender is not a borrower’s beneficiary; he would be the assignee on the collateral assignment after the borrower’s policy is in force. On the form, the borrower will be the assignor.

When a borrower fills out a collateral assignment form, that assignee supersedes the beneficiaries’ rights to the death benefit.

In case the borrower dies, the life insurance company would pay the lender or assignee, the loan pending. The rest of the death benefits (if any) shall go to your beneficiaries.

Inclusions in a Collateral Assignment Agreement

Parties involved: In the creation of this agreement, there are usually two parties involved; the first being assignor or company, and the second is the assignee or lender.

Effective dates: This agreement shall state the date when the agreement starts and when the agreement will expire, if applicable

Drafting a Collateral Assignment Agreement

In the collateral assignment agreement, by assigning the life insurance policy, it assures that the lender shall be paid the balance of the outstanding loan when the insured passes away.

The agreement is made in a policy form that is given by the life insurance corporation and must be signed by each of the parties involved, i.e., the lender, the borrower, as well as the life insurance provider.

A lender would also require his collateral assignment form to be signed by both the borrower and life insurance provider.

Benefits of Collateral Agreement

In a collateral assignment, the policy serves as collateral for a loan, making certain the lender would be paid if the borrower dies before making the full repayment.

Collateral assignments could be attached to any form of life insurance policy, and the conditions are subjected to negotiation.

Companies also willingly accept life insurance as collateral owing to the guarantee of funds in case the borrower dies or defaults.

In case the borrower dies before repaying the loan, the lender shall receive the outstanding amount through the death benefit, and the remaining sum is then directed towards other listed beneficiaries.

Types of a Collateral Assignment Agreement

Every type of life insurance policy could be acceptable for collateral assignment, providing an insurance company permits assignment for a specific policy.

Term Life Insurance Policy : In this form of a life insurance policy, lenders need the loan for a specific period that could coincide with the term of the loan. This may vary from five years, seven years, or even a ten-year policy can work.

After the loan is paid, an individual can cancel the policy or continue it, in which that individual still provides coverage and financial protection for the family.

Permanent Life Insurance Policy: In this form of a life insurance policy with particular cash value, allow lenders access towards the amount as repayment of the loan if the borrower were in default.

The policy owner’s access towards the cash value is then limited as a safeguard on the collateral.

However, if the loan is paid before the borrower demise, then the assignment is removed, and the lender has zero access towards the death benefit any longer.

What Happens When You Violate a Collateral Assignment Agreement?

When the policy is canceled or terminated for non-payment, the lender might consider that the loan contract has been breached in the absence of collateral. The non-payment notices or other policy changes document shall allow the lender towards proactively intervene and prevent termination. However, in such cases, the lender may be permitted to add payments made towards the insurance company to the outstanding loan principal.

[Also Read: Collateral Security Agreement]

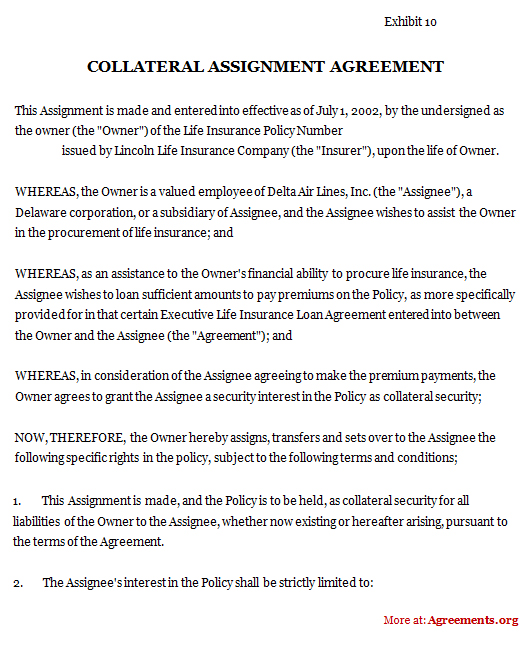

Sample for Collateral Assignment Agreement

A sample of the agreement can be downloaded from below.

Download this USA Attorney made original Agreement for only $9.99

By clicking the button below, I agree with the Terms & Conditions.