Collateral is an asset that a lender accepts as security for a loan. In case the borrower defaults on the loan payments, the lender could seize the collateral and resell it to recover the losses.

What is a collateral agreement? A collateral agreement is a type of a business agreement mentioning that an owner’s right of his personal properties would be transferred to another party or assignee as a sign of security for the repayment of debts.

When Do You Need a Collateral Agreement?

When one agent represents both a Buyer as well as a Seller (referred to as “double-ending a sale”), they stand to make twice as much commission, so discounts are often offered to the Seller. It is called a collateral agreement, is entirely legal, and this agent did properly disclose it.

Purpose of a Collateral Agreement

A collateral contract is a secondary agreement added towards the original contract that is intended to ensure that the pre-contract promises are met.

Collateral contracts are required to be strictly proved. A collateral contract could only arise if it satisfies all the following requirements:

- Promissory in nature

- Made with the purpose to induce the other party’s entry into the contract

- Should be consistent (and not directly contradict) the terms of the main contract

- Made before or at the time of formation

How to Draft a Collateral Agreement?

Collateral contacts are independent, oral, or written contracts that are made amid two parties to a separate agreement or between one of the original parties and a third party. This type of contract is frequently made before or simultaneously with the original contract.

There are four fundamentals necessary to establish a collateral contract, which includes:

- The statement is promissory in nature;

- The statement follows the promise;

- Consistencies amid main contract and alleged contract;

- The collateral contract should contain all elements of a contract.

Benefits of a Collateral Agreement

A collateral promise is a secondary promise, a promise that is ancillary towards a principal transaction or primary contractual relationship. There are three elements to a collateral promise:

- three parties,

- two promises, and a promise to pay a debt or fulfill a duty only if the first promisor fails to do so.

A collateral promise is a suretyship or guaranty contract. The main point is that the responsibility of the guarantor is secondary.

Types of Collateral Agreement

Banks and Brokers

When the agreement is made amid a broker dealing in securities and a lending facility, it is recognized as a general loan agreement and collateral agreement. This creates an open-ended agreement that allows the broker to borrow funds from the lender association for specific tasks on a continuous basis.

Most brokers use these collateral agreements to borrow money for margin accounts for their clients or for underwriting purchases.

Government

When a taxpayer uses collateral agreements, they are giving the IRS the ability towards collecting funds in addition to an amount of money agreed upon in the payment of debts. This could occur when the taxpayer cannot pay taxes and instead offers to pay a lower tax amount immediately while signing a collateral agreement that allows the IRS to collect the remaining difference in future years.

Future Income

When a taxpayer makes a collateral agreement with the IRS, it is generally for money that is taken from future income. Different collateral agreements collect different percentages of future income until the debt is fully paid off. The IRS usually designs collateral agreements, so the taxpayer would have enough future income left to pay off all living expenses.

Collateral Loan Agreements

Another classification of collateral agreements is the collateral loan agreement. These agreements are made amid banks and businesses or other private entities regarding loans. Many types of loans, such as mortgages and car loans, have some form of collateral agreement in the contract, but the words are not always used, and it is not always considered a separate document.

A collateral loan agreement is generally made for a specific type of loan that is given towards a business. The business provides real estate, funds, equity, life insurance, or some other type of investment as collateral in return for a loan from the bank to buy a property or start a new project. These collateral loan agreements are rarely made with individuals.

Government Transactions

A collateral agreement is additionally made amid banks and smaller governing entities, for example, city councils and sometimes state governments. These collateral 1agreements are similar in nature towards the agreements made among banks and brokers, except that the agreement is made with a state treasurer and concerns investment into securities by the government.

Key Terms of a Collateral Agreement

A collateral agreement doesn’t necessarily name a specific number as a payment that will be given, either to a broker or the government. Rather, collateral agreements are utilized as a part of other contracts that refer to funds in addition to a particular sum set out on account of the IRS, and the collateral agreement allows it to take extra money based on taxpayer conditions. When dealing with banks, it gives brokers the ability to borrow funds to purchase securities. Whatever contract you may enter into, it is important for both parties to define the collateral the same.

The collateral contract co-exists side by side Collateral contracts are independent oral or written contracts that are made amid two parties to a separate agreement or amid one of the original parties and a third party. This type of contract is normally made before or simultaneously with the original contract.

What Happens When You Violation?

A party to an existing contract might attempt to show that a collateral contract exists if their claim for a violation of contract fails because the statement, they depended upon was not held to be a term of the principle contract. It has been held that for this to be successful, the statement should have been promissory in nature. Remedies might be awarded for breach of a collateral contract.

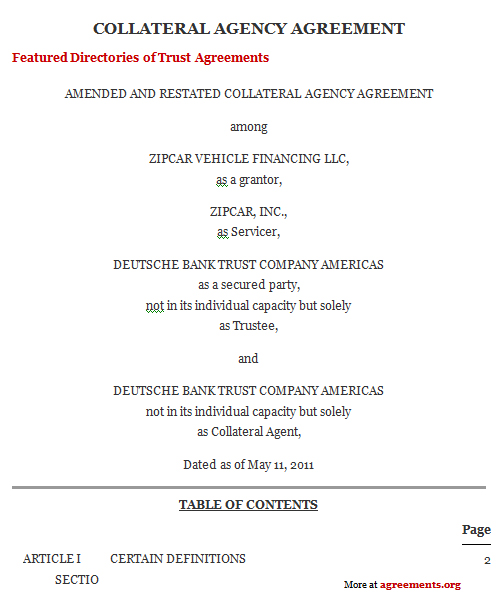

Sample for collateral agreement

A Collateral agreement sample as a pdf or a doc can be downloaded from below.

Download this USA Attorney made Original Agreement for only $9.99

By clicking the button below, I agree with the Terms & Conditions.This agreement is made between the “Assignor” and “Receiver” on the effective date of 16th November 2011. Assignor represented by Mr. Jones Dow Top Drive Address: 4208 10th Lane Northeast, Drake ND 58736 Contact number: (701) 838-9715 Receiver represented by Mr. Arjun Nagpal Address: 1796 Lake Street, Bristol NH 03222 Contact number: (603) 744-6320 Terms and Conditions:

- The “Assignor” of this Agreement can enter other guarantee obligations at any point in time under a single or multiple “Interest Rate Protection Agreement” or any other Agreements including “Hedging Agreement” with another “Receiver” or several “Receivers.”

- This Agreement has been drafted and made by the “Assignor” in favor of the said “Receiver” – Mr. Arjun Nagpal, dated 16 Nov 2011 and valid for a period of two (2) years.

- The “Receiver” under this Agreement will transfer or assign their title, right, and interest to the said “Assignor.” This will include any interest or right currently owned or acquired after the Agreement is made.

- If there is a dispute in the near future between the “Assignor” and the “Receiver” concerning responsibility and guarantee or future risk related to the referenced Collateral in this Agreement, then either party can choose to terminate this agreement or settle it with the help of an arbitrator.

- The Collateral mentioned in this Agreement will not reduce or increase in value if its value in the market increases or decreases.

IN WITNESS WHEREOF, the parties “Assignor” and “Receiver” have executed this Agreement as on the date set forth, which is 11/16/2011 (MM/DD/YY). SIGNED FOR AND ON BEHALF OF ASSIGNOR BY: ……………………………………………………………. Name: SIGNED FOR AND ON BEHALF OF RECEIVER BY: ……………………………………………………………. Name: