What Is a Charity Plan Agreement?

A Charity Plan Agreement is drafted when a company or individual decides to donate money or other precious objects to a non-profit organization. The agreement is evidence of the deal signed between the donor and the donee, ensuring that the recipient of the Donation will not utilize the money inappropriately.

When Do You Need a Charity Plan Agreement?

This greement is signed between the donor (who plans on donating money) and the donee (recipient of the Donation). The agreement is needed to ensure that the donee will use the donated money for a proper cause, i.e., for the welfare of the needy.

The agreement assures the donor by guaranteeing the appropriate use of the charity. The organization (donor) can also demand a non-profit company to use charity for a particular cause, such as poor children’s education.

Inclusions in Charity Plan Agreement

A standard charity business plan template contains the following terms

- An introduction to both organizations, i.e., the company donating money and the recipient of the amount.

- Term of the contract

- Amount of Donation

- Expectations of the donating company

- Confidentiality Clause

- Eligibility Clause

- Terms and Conditions

- Whether the donation would be continuous or one-time

- Whether such donation would amount to endorsement of every activity

- Whether the donation is conditional upon any activity

- Whether the donation is intended for a certain purpose

- Waivers of liability

- Indemnification of the charity to the issuer

- Permissions to use the issuer’s brand for marketing purposes

- Representation and Warranties

- Covenants

- Payment of taxes and other fees

- Events that constitute termination of the agreement

[ Also Read: Donation Agreement ]

How to Draft a Charity Plan Agreement?

While drafting an agreement, ensure to include;

- Introduction of both parties, i.e., donor and donee

- Mention the amount of Donation

- List all the terms and conditions each party must follow

- Specify the start and end date of the contract

- Add confidentiality clause

- Applicable Laws

- Waiver of liability

- Indemnification by the trust

Additionally, you can add other clauses with the mutual consent of both parties.

Benefits of Charity Plan Agreement

Proper Utilization of Donation: This agreement ensures that the donee will use the money appropriately. As soon as the contract comes into effect, the donee will be responsible for using the charity for the given purpose.

Avoid Conflicts: This agreement is a legal contract that is drafted to protect the interest of the donating organization and the non-profit. It specifies all the terms that each party has to follow.

Protect the Interest: The contract protects the interest of donor and donee by laying out their responsibilities.

Key Clauses in Charity Plan Agreement

The key inclusions are

- Identity Clause

- Term of the agreement

- Eligibility Clause

- Purpose of the Program

- Donation

- Confidentiality Clause

- Terms and Conditions

- Indemnification

- Waivers of liability

What Happens in Case of Violation?

Both parties signing the deal must read and understand each clause mentioned in the contract before signing the agreement. Once the agreement comes into effect, each party will be required to abide by all the clauses.

If any party breaches the contract, they will have to pay the penalty. Failure to donate the promised amount, improper utilization of the donated money, or inability to stick to the terms and conditions of the agreement will result in contract termination.

Most charities have routine agreements that specify the obligations and rights of the donor and the charity. The larger the gift, especially when compared to other major gifts received by the non-profit, the greater the negotiating leverage of the donor. Charity Plan Agreement should memorialize the goals and objectives mutually agreed to by the donor and donee, and also build flexibility in case of unforeseen circumstances.

[Also Read: Director Charitable Award Plan Agreement]

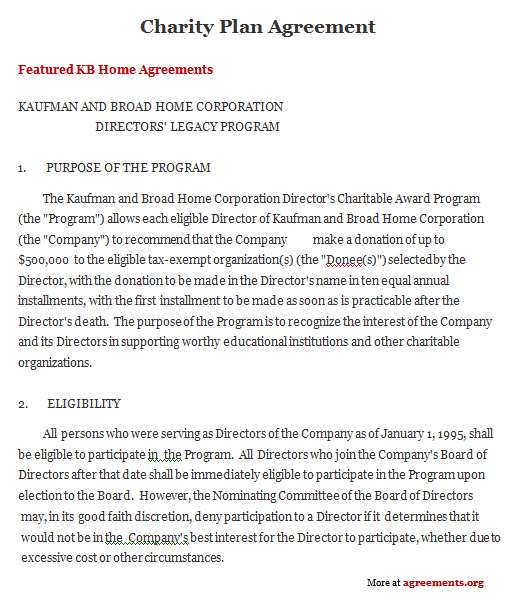

Sample Charity Plan Agreement

Download this USA Attorney made Original Agreement for only $9.99

By clicking the button below, I agree with the Terms & Conditions.Donor represented by

Mr. David Villa

Chase & Villa

Address: 1615 East Central Road #301A, Arlington Heights IL 60005

Contact number: (847) 514-3551

Donee represented by:

Ms. Alicia Livingstone

Friends of Animals

Address: 22 South Ridge Avenue, Arlington Heights IL 60005

Contact number: (847) 997-3450

Terms and Conditions:

- This Charity Plan Agreement allows each eligible Director of “Chase & Villa” to recommend the Organization for making a maximum donation of up to $700,000 to a tax-exempt organization, Non-governmental organization known herewith as the “Donee(s)”. The “Donee” will be selected by the eligible Director(s).

- Only those serving as Directors in “Chase & Villa” as of November 15, 2011 will be eligible to create amendments and implement this agreement.

- Each Director of “Chase & Villa” can choose one “Donee” a year, who will receive a maximum donation amount of $700,000, or they can choose up to five “Donees”, who will receive donations up to $140,000 each.

- A “Donee” needs to be eligible as mentioned in the Section 7 of this agreement in order to receive the donation from “Chase & Villa”. The recommended “Donee” must be a charitable organization exempt from tax or an educational institution and must be able to show IRS notice of qualification for receiving tax deductible contributions to the “Donor” prior to the donation.

IN WITNESS WHEREOF, the parties “Donor” and “Donee” have executed this agreement as on the date set forth which is 11/15/2011 (MM/DD/YY).

SIGNED FOR AND ON BEHALF OF DONOR BY:

…………………………………………………………….

Name:

SIGNED FOR AND ON BEHALF OF DONEE BY:

…………………………………………………………….

Name: