What Is a Cash Collateral Agreement?

Cash collateral agreement is signed when cash and cash equivalents are required to be held by the lenders during a chapter 11 bankruptcy. The US code 11, u/s 363 defines cash collateral as ‘cash, negotiable instruments, documents of title, securities, deposit accounts or other cash equivalents, whenever acquired, in which the estate and an entity other than the estate have an interest and includes the proceeds, products, offspring, rents, or profits of property and the fees, charges, accounts or other payments for the use or occupancy of rooms and other public facilities in hotels, motel or other lodging properties subject to a security interest as provided in section 552(b) [of this title] whether existing or after the commencement of a case under this title.’

The funds in the collateral account become the property of the lender. There is a minimum balance that must be maintained by the borrower at all times. The agreement will have the amount of collateral provided by the bank and penalties for the inability to maintain the required balance.

When Do You Need a Cash Collateral Agreement?

A cash collateral pledge agreement is insisted upon by the lender when there is a possibility of default by the borrower and it is used for credit risk management. This agreement ensures that the loan is paid promptly. These types of contracts are used when the borrower has a poor credit score and repayment history. The company’s financial profile is reviewed before the loan is sanctioned.

Inclusions in the Cash Collateral Agreement

As per the cash collateral agreement definition, it is an agreement where the lender secures the repayment of the loan provided to the borrower. The following information is found in such agreements:

- The names of the pledgor and the bank

- Legal action in case of default

- Loan sanctioned by the lender

- The effective date of the agreement

- Limit to be maintained by the borrower

- Investing the amount in the accounts

- Representations, warranties, and covenants

- Waiver of liabilities

- Expenses to be paid

- Continuing Security Interest

- Further Assurances

- Amendments to the agreement

- Notices

- Governing laws and jurisdiction

How to Draft a Cash Collateral Agreement?

You can draft an agreement using a cash collateral agreement template. The following points should be considered:

- Both parties should be of legal age, not under the influence of alcohol or coercion

- The details of the account being opened to deposit the collateral

- Governing law which needs to be adhered to

- Resolution of disputes

- Events which lead to termination of the contract

- Investment strategies for the cash

- Minimum amount to be maintained

- Further assurances to be given

- Remedies for default

Benefits of a Cash Collateral Agreement

A cash collateral security agreement is meant to ensure that the loan provided by the lender does not turn into a bad debt. The funds in the account are for the benefit of the lender and the lender can withdraw money from the account at regular intervals. The lender has assured the repayment of the entire principal and interest related to the loan.

Key Terms/Clauses in a Cash Collateral Agreement

If you go through a cash collateral agreement form, you will find the key terms/clauses that should be part of the agreement. They are:

- Definitions: The various terms used in the agreement

- Pledge and assignment: The account number being pledged, any certificates towards the cash collateral account

- Remedies upon Default: Redemption of securities pledged by the borrower for the realization of proceeds

- Maintaining cash collateral account: There is a certain balance which is a percentage of the loan sanctioned that needs to be maintained by the borrower at all times

- Representations and warranties: The securities pledged by the borrower must have a clear title

- Covenants: The pledgor does not have the right to assign or transfer the collateral

- No discharge, survival of claims.

- Waiver: The borrower will not make any claim on the lender

- Expenses: Any expenses incurred by the lender to claim any outstanding dues such as attorney fees

- Continuing security interest: The interest ends when the borrower has cleared all obligations

What Happens in Case of Violation?

In a cash collateral agreement, the lender’s dues are protected through the cash collateral facility. In case of a violation, however, the lender has the right to take legal action against the borrower as per the laws governing the state in whose jurisdiction the case has been filed. The company that filed for chapter 11 forfeits the cash protection and the lenders have the right to the collateral. However, in most cases, remedies for breach are mentioned in the contract itself. Otherwise, Chapter 11 has an extensive code of operation.

[Also Read: Cash Collateral Pledge Agreement]

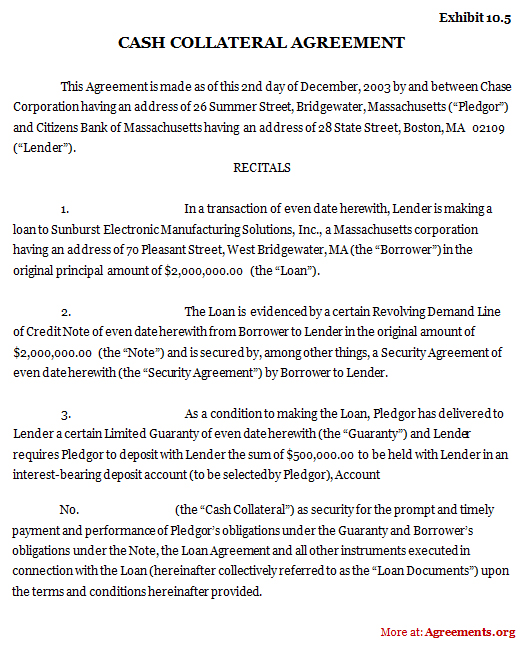

Sample for Cash Collateral Agreement