A Capital Accumulation Plan Agreement is a legal contract between an employer and an employee which documents the post-retirement benefits payable to the employee. The agreement also outlines the death benefit payable to the nominees of the employee as well as savings through tax planning. The details of the various plans are provided and the eligibility of the employee according to the grade are mentioned.

The agreement also contains information about the choice of the employee to receive the various benefits, whether lump sum or deferred payments. Capital accumulation plans include defined contribution pension plans, group retirement savings plans, and education savings plan. The Lockheed Martin Capital Accumulation Plan is an excellent example of such agreements.

When do you need Capital Accumulation Plan Agreement?

A Capital Accumulation Plan Agreement is required when the employer wants to offer multiple options to employees like defined contribution pension plans, education savings plans or group retirement savings plans as a tax-deferred investment, or savings options. These benefits of a capital accumulation plan are part of the salary and help employees save on the initial tax liability while contributing to their retirement, purchasing a new home or the educational expenses of their children.

The purpose of Capital Accumulation Plan Agreement is for the employer to defer a portion of the salary payable to the employee through additional employee benefits like profit sharing for senior staff through stock options. By deferring a portion of the salary, the employee gets significant tax benefits.

Inclusions in Capital Accumulation Plan Agreement

A Capital Accumulation Plan Agreement is a bipartite agreement between the employer and the employee, so the names of the employer along with the registered office address and the employee must be included in the agreement.

The Capital Accumulation Plan Agreement must have the effective date of the agreement, the date of vesting of the benefit, the interest payable, provisions for non-competition and non-solicitation, payment form election as to whether payment will be received in a lump sum or instalments, benefit commencement date, relationship to the benefit plan document, details of employee death benefit and retirement benefit, alternative deferred compensation, employment agreement, terms of employment, duties, bonuses, stock options, other employment benefits as well as events which lead to termination of service.

The agreement should also mention the name and relationship of the beneficiary along with the compensation payable to them in the event of death of the employee.

How to draft Capital Accumulation Plan Agreement?

The following things need to be kept in mind when drafting a Capital Accumulation Plan Agreement:

- The names, designations of the parties to the agreement along with the relationship shared between them should be clearly mentioned

- The options offered by the employer and the chosen by the employee needs to be stated

- If there is a beneficiary other than the spouse, then the consent of the spouse is required

- Compliance of the agreement with the applicable laws of the state is required

- The conditions under which the agreement can be terminated should also be stated

- The amount being deferred and contributions being made to the different benefit plans should also be stated

- The method of performance appraisal and the targets to be achieved to qualify for the benefits also needs to be mentioned, along with revisions, if any, in the performance criteria.

Benefits of Capital Accumulation Plan Agreement

The benefits of having a Capital Accumulation Plan Agreement are as under:

- The deferment of a portion of the salary by including contributions to defined benefit plans and stock options leads to substantial tax savings for the employees

- The benefits offered by the company acts as an incentive for the employee, who is motivated to achieve the targets set by the company. These benefits both the employee and the employer.

- The employee has the option to choose the defined benefit or group savings plan according to their requirement and the payment option as well.

Drawbacks of Capital Accumulation Plan Agreement

The drawbacks of a Capital Accumulation Plan Agreement are mentioned below:

- The employer lays down certain conditions with regard to sale, transfer or trade of the stock options before vesting is possible. There are a lot of employees who forgo the right to own a portion of stock compensation for this reason.

Key terms in Capital Accumulation Plan Agreement

The key terms of a Capital Accumulation Plan Agreement are as follows:

- Definitions: The definition of various terms like account, base salary, company stock investment option, eligible employee and so on are mentioned here

- Purpose of the plan: The benefits that the employer intends to provide to the employees through this plan are mentioned here.

- Eligibility: The commencement of participation and the cessation of eligibility while still an employee are explained here.

- Contributions: The contributions to be made by the employer as well as the employee are mentioned here. The account where the contributions are credited and the date of vesting are also mentioned.

- Payment of benefits: The date of commencement of the payment and the form of payment, whether in lump sum or instalments are stated

- Amendment or termination: The rights of the employer to terminate the agreement.

If you want to provide post-retirement benefits to an employee, then it is advisable to draft a Capital Accumulation Plan Agreement.

You can download a sample Capital Accumulation Plan Agreement here.

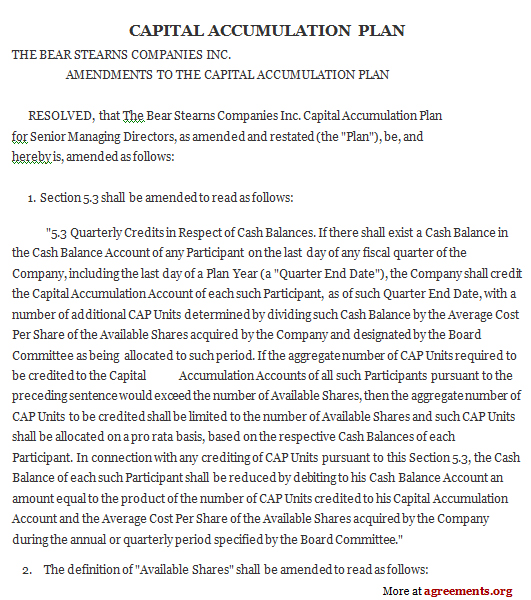

Sample Capital Accumulation Plan Agreement

Download this USA Attorney made Original Agreement for only $9.99

By clicking the button below, I agree with the Terms & Conditions.This agreement is made between Company and Employee on the effective date of 13th November, 2011.

Company represented by

Mr. James McCormack

CEO

Address: 2815 West 63rd Street, Chicago IL 60629

Contact number: (773) 317-4736

Employee represented by:

Mr. William Redford

Address: 6922 South Rockwell Street, Chicago IL 60629

Contact number: (708) 424-2159

Terms and Conditions:

- “Compensation” stands for the base salary payable to the employee and includes the bonus earned by the employee of the Company. It is considered as a “wage” for the purpose of federal income tax withholding.

- The participation of the employee in the Capital Accumulation Plan will be effective only upon notification to the said employee by the Company’s governing committee or board of directors with regards to eligibility for participation, completion as well as submission of the Deferral Commitment by the fifteenth day of the first month preceding immediately the Deferral Period.

- The company has allotted the maximum compensation percentage deferred to be twenty percent (20%) as a part of each base salary payment and a minimum deferral amount of three percent (3%) of the compensation.

- If the said employee terminates their employment with the company, for any other reason than death, then the company will pay the employee Capital Accumulation Plan benefits that are equal to the current balance in the employee’s account.

- In case of death of the employee, the Company will pay benefits to the employee’s Beneficiary and shall be equal to amount of the employee’s vested Account balance.

IN WITNESS WHEREOF, the parties “Company” and “Employee” have executed this Capital Accumulation Plan as on the date set forth which is 11/13/2011 (MM/DD/YY).

SIGNED FOR AND ON BEHALF OF COMPANY BY:

…………………………………………………………….

Name:

SIGNED FOR AND ON BEHALF OF EMPLOYEE BY:

…………………………………………………………….

Name: