A Brief Introduction on How to Set up a Bonus Program

Every company achieves success with the help of employees working in it. If you want to make sure that your employees grow their professional level in the office, then you should look for the best bonus programs. These days, most of the big companies prefer bonus agreements with which the employees get motivated. There are performance bonuses, lump-sum bonuses, and year-end bonuses, referral bonus programs, refund bonus programs, which are included in such agreement.

Who Takes the Bonus Program?

This agreement is taken by the employee of the company from the employer. This agreement includes all the bonuses which will be received by an employee at a certain time period.

Purpose of the Bonus Program

This is useful when a company wants to implement a ‘bonus pool’ for disbursing the bonuses. It helps in assigning responsibility for not only deciding on the amount that the bonus pool must contain but also for identifying who will disburse it. A bonus program agreement helps in planning for annual bonuses. It also binds the employees to the terms of eligibility and distribution of bonuses. Having an agreement in place makes the eligibility criteria clear to the employees and incentivizes hard work.

Contents of the Bonus Program

A standard bonus program template would include the different kind of bonuses which an employee can get every year. Some of the clauses that are included in the agreement are

- The Objectives and purpose of the contract: This agreement highlights why the agreement is being made and who it would be applicable to

- The Effective Date: It should also outline the date from which the agreement would apply, and the period for which the agreement would be valid

- Eligible Employees: The eligibility criteria for the contract not only includes performance metrics, the dates of joining as well. It should outline the cutoff date before which employees’ performance would be considered for performance development

- Bonus Pool: When defining the bonus pool, the company should mention the percentage of profits that would be set aside for bonuses. It is important to define what net profits for the purpose of the pool means. It should also mention how the allocation of bonuses would be done to the eligible employees.

- Compensation: When calculating bonuses to be disbursed, the company should identify the basis on which the bonus would be disbursed. For the calculation of such a percentage of the bonus, a base should be defined. This base could be the salary by adding or deducting elements

- Payment and Termination: The agreement should also contain information on the method of disbursal of the bonus — whether it would be paid out in cash or otherwise. The agreement should mention the circumstances that would cause the employee to be terminated from the eligibility for the bonus, or from the organization. This agreement should specify the eligibility in case of terminated employee.

How to Draft the Bonus Program?

When you want to draft the agreement, you should call a reputed lawyer so that you will add all the necessary guidelines in it.

Year-end bonuses and incentive plans should clearly be mentioned in this agreement. There is an incentive bonus for the employee after reaching a particular target, and it is divided individually, and there is also another bonus for the team projects.

If the employee wants to negotiate regarding a bonus, then he/she can do it before the agreement; otherwise, it won’t be possible later. If the company wants to negotiate regarding the bonus amount, then the employee has the right to sue the company for it.

Benefits and Drawbacks of the Bonus Program

The employees are benefitted from the agreement as they are motivated to work with more dedication, and this results in the benefit of the company also. In case, the company faces losses even after the hard work of an employee; then there are chances that the company has to face loss in such a case.

What Happens in Case of Violation?

If any of the parties violates the law, then the required action is taken as per mentioned in the agreement. The reason due to which agreement is signed between the company and the employees is to ensure nobody misuses rights in any form.

You must have understood the basic outline of the agreement. If you want to sign such an agreement, ensure to keep in mind all the guidelines and rules. If you are an employee, then the bonus agreement will let you know about your progress in a particular organization.

You can Download the sample employee bonus program customize it according to your needs and Print. Bonus Program Agreement is either in MS Word, Excel or in PDF.

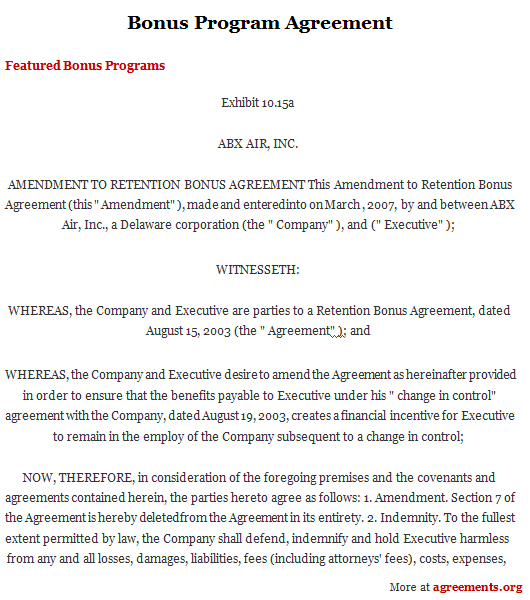

Sample Bonus Program Agreement

Download this USA Attorney made Original Agreement for only $9.99

By clicking the button below, I agree with the Terms & Conditions.This agreement is made between Company and Employee on the effective date of 15th November, 2011.

Company represented by

Ms. Susan Ward

Encosoft Media

Address: 50 Biscayne Boulevard, Miami FL 33132

Contact number: (305) 415-9588

Employee represented by:

Ms. Gabriele Mendez

Address: 720 Northeast 62nd Street #304, Miami FL 33138

Contact number: (305) 704-0027

Terms and Conditions:

The said Employee “Ms. Mendez” should be an active employee (this includes approved leave of absence) of “Encosoft Media” or the subsidiary (“Enchilda Media”) on November 15, 2012 also known as the “First Retention Date”, to receive a retention bonus, to the amount of $120,000 known herewith as the “First Retention Bonus”.

In addition to the retention bonus, “Ms. Mendez” is qualified for the “First Incentive Bonus” if she remains an active employee (this includes approved leave of absence) of “Encosoft Media” on December 31, 2012 known here with as the “First Incentive Date”. She will be eligible for a maximum incentive bonus amount of $210,000 known herewith as the “First Incentive Bonus”.

The Retention and Incentive bonus will be paid:

in once a year in a lump sum,

every month as a part of payroll

based on the normal payroll practice of “Encosoft Media”,

subject to miscellaneous deductions and tax withholding

IN WITNESS WHEREOF, the parties “Company” and “Employee” have executed this Bonus Program Agreement as on the date set forth which is 11/15/2011 (MM/DD/YY).

SIGNED FOR AND ON BEHALF OF COMPANY BY:

…………………………………………………………….

Name:

SIGNED FOR AND ON BEHALF OF EMPLOYEE BY:

…………………………………………………………….

Name: