An asset transfer agreement, also known as an asset purchase agreement, transfer of assets agreement, memorandum of transfer property, is an agreement that finalizes the terms and conditions related to the purchase and sale of a company’s assets. An asset sale is where the business’ assets are transferred to a new owner without the actual ownership of the business being transferred. Rather than acquire all of the shares in a company and therefore, both its assets and liabilities, very often a buyer will prefer to only take over certain assets of a business. Typically, in an asset purchase, the company itself will be selling the assets, whereas in a share sale, the individual shareholders will be the sellers.

When Do You Need an Asset Transfer Agreement

An asset transfer agreement is needed when the assets of a company need to be sold or transferred to another person. This is necessary for a business if it’s ready to purchase another business’ assets and want the terms and conditions defined. The agreement also helps the buyer to have proof of the transfer and the fact that he is now the owner of those assets.

This purpose of the asset transfer agreement is that it helps to make the transfer formal and legally binding. It protects the interests of both the transferor and the transferee.

An asset purchase enables a buyer to pick exactly which assets they are buying and identify precisely those liabilities they wish to take over.

Inclusions in an Asset Transfer Agreement

The agreement must clearly state the names of the parties between whom the agreement is entered into. This will include a Seller (or Transferor) and a Buyer (or Transferee). The date on which the agreement is entered into must also be mentioned along with the territory in which the agreement is enforceable.

The agreement must lay down clearly what assets are being transferred. Assets transferred as part of an asset transfer agreement may include plant and machinery, stock, contracts, premises, know-how and goodwill.

With an asset purchase, the buyer may be selecting only specific assets, leaving behind redundant assets. Hence, the selected assets must be itemized in a schedule to the agreement.

Apart from this, the agreement must clearly mention under which law it will be governed and how the agreement shall be terminated. The manner in which the agreement is to be modified should also be described.

How to Draft an Asset Transfer Agreement

The following is the process to be followed while drafting an asset transfer agreement:

- A letter of intent should be drafted to outline the terms agreed to by both the parties.

- A due diligence should be conducted by the buyer to make sure the seller has a clear title to the assets being sold.

- The asset transfer agreement will be drafted post the due diligence.

- Both parties should thoroughly review the agreement to make sure their interests are protected.

- The agreement should be signed by both parties.

- Once the agreement is signed the ownership, security interests, etc. will be transferred to the buyer and the transaction is complete.

Benefits of an Asset Transfer Agreement

- The main benefit is that the buyer can pick the assets and liabilities that he would like to acquire. This reduces the risk of hidden liabilities as is the case with a share purchase.

- An asset transfer agreement puts the terms and conditions of the transfer into writing. This makes the transaction crystal-clear and avoids any misunderstandings.

- Through this agreement the transferor shows how he is the owner of the asset. This gives faith to the transferee in the transaction.

- It creates a binding transfer.

- All the warranties and representations of the transferor and transferee are spelt out. This protects the other party from any misrepresentation.

Consequences of Not Having an Asset Transfer Agreement

- Without an asset transfer agreement in place, a dispute between the parties could end up in court and lead to a legal mess.

Key Clauses in an Asset Transfer Agreement

The following are the key terms of an asset transfer agreement:

- Sale, purchase and transfer of specified assets

- Purchase price

- Method and schedule of payment

- Completion of transfer

- Representations and warranties of the transferor

- Representations and warranties of the transferee

- Conditions precedent

- Pre-Closing Covenants

- Conditions subsequent

- Post Closing Obligations

- Events of default

- Remedies for events of default

- Execution and delivery

- Indemnification and damages

- Modification of the agreement

- Termination of the agreement

- Governing law and jurisdiction

- Dispute resolution and arbitration

- Notices

What Happens When You Violate an Asset Transfer Agreement

Generally, asset transfer agreements have a clause that talks about the actions to be taken when a party to the agreement breaches the clauses of the said agreement. An arbitration clause is present in most agreements and states that if a clause of the agreement is breached or if any dispute arises with respect to the terms of the agreement, the matter will be resolved by arbitration. The clause mentions where the arbitration proceedings will take place i.e. seat of arbitration, the language in which the proceedings shall be conducted and the manner in which the arbitrators shall be appointed.

Alternatively, any other form of dispute resolution such as mediation may also be mentioned in the agreement.

The agreement can also mention that all disputes arising out of the agreement will be subject to the exclusive jurisdiction of a specified court.

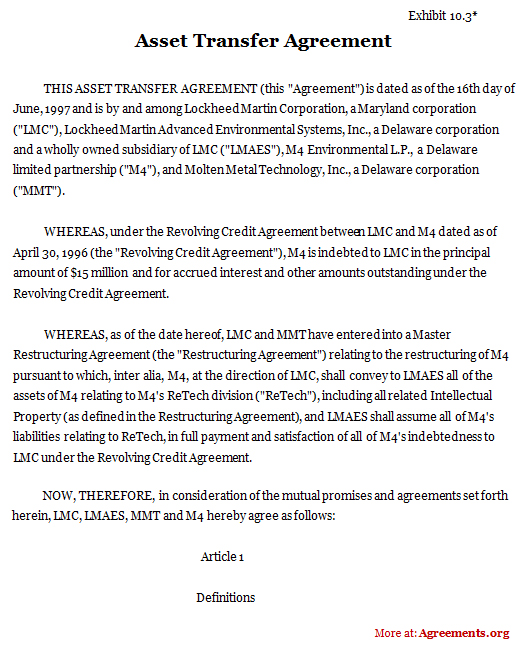

Sample of an Asset Transfer Agreement

If you require a template of a simple asset transfer agreement, you can download an asset transfer agreement template here.

Download this USA Attorney made original Agreement for only $9.99

By clicking the button below, I agree with the Terms & Conditions.