Asset management refers to the practice of managing investments on behalf of others. It is carried out by an asset management company which is a financial services institution, or it may also be an individual. This company determines which financial products to invest in and which to avoid. The main idea behind it is to derive profits from the investments and also reduce the risks involved. The investors are mostly high net-worth individuals (HNWI), governments, and corporations. They invest in different industry sectors, such as real estate and finance. This has given rise to different categories of asset management, such as financial asset management, real estate asset management agreement, IT asset management, and asset property management.

What Is an Asset Management Agreement?

It is a formal document that governs the arrangement between a company providing asset management services and the investor. It lists the conditions and the extent to which the asset management company can act about the specific assets mentioned in the agreement. It can be tailored according to different investors. It must comply with the relevant laws, regulations, and guidelines.

When Do You Need an Asset Management Agreement?

Asset management services are utilized mainly by corporations, governments, and HNWIs who have many investments to be managed. If you are one of them, it is advisable to appoint asset managers. They look after the investments and get higher returns. Asset management firms have specialized knowledge and resources to conduct extensive market research. This helps to make a correct investment decision. When engaging their services, you (as a client) should enter into an asset management contract. It serves as a formal proof of the relationship and puts down the duties and liabilities in a written form, thereby avoiding any confusion between the parties.

Key Terms in Asset Management Agreement

Some of the key terms to be incorporated are:

- Names of the parties- the client and the asset manager

- Authority of the asset manager

- Assets to be managed

- Term of the agreement

- Guidelines within which the investments should be managed

- Fees of the asset management company

- Custodian that will hold the assets

- Duties of the asset management company

- Confidentiality

- Reporting obligation of the asset manager

- Liability of the asset manager

- Grounds for termination

- Governing law of the agreement

- Signature of both the parties

Drafting an Asset Management Agreement

The following points should be kept in mind when drafting the simple asset management agreement:

- Clearly, describe the assets that are to be managed by the asset manager. This clause should include information about the assets such as the account number in the financial institution where the asset and deposits are kept.

- Mention the type of authority that the asset manager can exercise. It can either be discretionary, where the asset manager does not need to consult the client; or non-discretionary, where he has to consult the client before conducting any transaction relating to the investment.

- Both parties should discuss the investment guidelines according to which the accounts will be managed. These may include the objectives of the investment or any investment restrictions prescribed by the client.

- The fees to be paid to the asset manager for its services should be mentioned. It is a common business practice to state the fee as a percentage of the asset. The mode and time of payment of the fees must be stated in clear terms.

- The custodian who will hold the assets in the account must be mentioned. It should be a reputed financial organization that is not related to the asset manager in any way. This is done to avoid any conflict of interest.

- The duties of the asset manager must be clearly stated. These may include its obligation to protect the client’s interests and to exercise due diligence.

- A provision of confidentiality should be included to protect sensitive information from being leaked unless it is demanded under any law.

- The agreement should state the reporting obligation of the asset manager- how often it should furnish reports (whether quarterly or half-yearly) and the contents to be covered therein.

- The liability of the asset manager in case of its willful and negligent misconduct must be laid out.

- The grounds under which the agreement can be terminated must be explained.

- It is important to mention the law that will govern the provisions of the agreement so that there are no jurisdictional issues.

- Ensure that both parties sign the agreement.

Types of Asset Management Agreement

These are broad of two types:

- Special asset management contract: In such an agreement, the investor (client) lays out the investment policies to be followed by the asset manager.

- Standard asset management contract: This agreement is more general in nature where the asset manager is given the authorization to make investment decisions without consulting the investor (client) every time.

Benefits and Drawbacks of an Asset Management Agreement

Benefits:

- Having asset managers to take care of investments saves time and resources.

- Since asset managers are tasked with one specific function, they bring in expert knowledge with them. This helps them to serve their clients to the best of their abilities.

Drawbacks:

One major disadvantage of the asset management contract is that the client surrenders some control to the asset manager. Though it can negotiate the terms of the agreement and decide the limits within which the manager will function, the final action is taken by the asset manager.

What Happens in Case of Violation?

In simple asset management agreement, the parties can mutually decide the scenario when its terms are violated. When a party defaults, the asset management contract is terminated. The defaulting party can be asked to compensate the other party by paying an amount equivalent to the loss suffered. Both parties should agree on a mechanism to settle disputes. The preferred mode is arbitration. However, if there is no specific mode of dispute resolution stated in the agreement, the aggrieved party can sue the defaulting party in the local court for breach of contract.

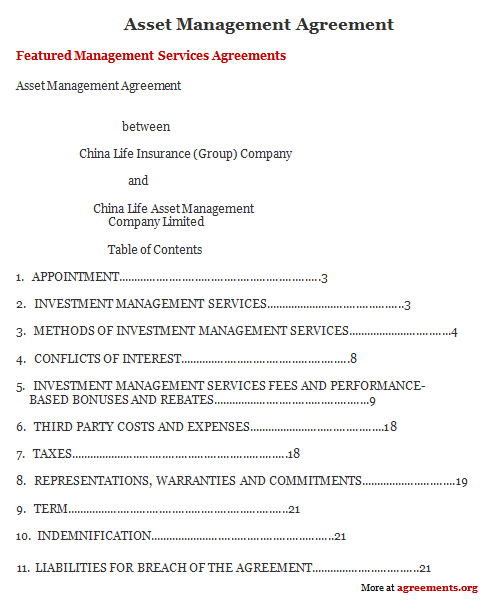

Sample Asset Management Agreement

Asset management agreement template can be downloaded from below.

Download this USA Attorney made Original Agreement for only $9.99

By clicking the button below, I agree with the Terms & Conditions.This agreement is made between the Owner and the Asset Manager on the effective date of 10th November, 2011.

Owner represented by

Ms. Natalie Reed

Address: 500 Gallery Blvd, Scarborough ME 4074

Contact number: (207) 885-5567

Asset Manager represented by:

Ms. Melanie Radcliffe

Address: 15 Tibbetts Drive, Brunswick ME 4011

Contact number: (207) 725-0773

Duration of Agreement: 1 year

Terms and Conditions:

- Owner engages Asset Manager to provide services set forth in this Asset Management Agreement relating to the management, administration, supervision and disposition of the assets described in Schedule 1 of the Asset Management Agreement.

- The Asset Manager shall provide all said services customarily and ordinarily provided by asset managers towards preserving, protecting and maintaining the Assets.

- Within thirty days from the Effective Date or the date of the Asset Management Agreement, Asset Manager shall prepare and submit a strategic business plan to the Owner discussing each of the Assets and containing recommendations concerning the operation, ownership, maintenance, and disposition thereof.

- The Asset Manager is authorized and empowered, as the Owner’s agent, to enter and engage in contracts with third parties in order to provide the services referred to in the Asset Management Agreement.

This Asset Management Agreement shall be active when the parties “Owner” and “Asset Manager” set their seals as on the date 11/10/2011 (MM/DD/YY).

SIGNED FOR AND ON BEHALF OF OWNER BY:

…………………………………………………………….

Name:

SIGNED FOR AND ON BEHALF OF ASSET MANAGER BY:

…………………………………………………………….

Name: