A 364-day credit agreement or a revolving credit agreement as it is commonly called is an unsecured revolving agreement under which loans are borrowed in order to meet various corporate needs including the issuance of commercial papers, working capital, acquisitions, and capital investments. Such a contract comes under a private line of credit.

A line of credit is typically provided to a company in lieu of a commitment fee. This credit line may be withdrawn in totality or partially by the banks. If the company is in good financial health, renegotiations of the credit line may also be done. As it is an unsecured debt, it is extended to only financially secure clients, after a thorough financial assessment. One needs to be careful about drafting the same. Information about the parties involved, the timeline for redemption or repayment, remedies, etc. need to be carefully included.

Purpose of a 364-Day Credit Agreement

A 364- day credit agreement, creates a line of credit to the company to meet its general corporate needs. Being in the nature of unsecured credit, it is easier to obtain. It is considered one of the best ways to obtain short-term financing. These are funds that can be accessed at any point of time and have a short maturity date and hence can be used for day-to-day corporate needs.

Inclusions in a 364-Day Credit Agreement

A revolving credit agreement should be apart from the key operational and commercial terms, including the names of the parties, effective date, timelines for repayment, purposes of the borrowing and standard clauses such as dispute resolution, waiver, remedies, notices, choice of law, entire agreement and severability. As it is a credit agreement, definitions and interpretations should also be mentioned herein.

Key Terms in a 364-Day Credit Agreement

The following key terms need to be included in a revolving credit agreement:

- Quantum of loan and number of credit facilities: The revolving credit agreement should mention clearly, the amount of loan advanced, and the number of credit facilities. Sometimes when the amount of loan is high, credit facilities in several tranches is given.

- Purpose of the borrowing: A broad but clear purpose of why the loan is being taken should be mentioned.

- Conditions of utilization: Conditions precedent, which would entitle the borrower to utilise the money should also be laid down. An example of a condition precedent is that in order to utilise the loan the borrower must not have committed any event of default.

- Repayment Schedule: The repayment timeline should be mentioned in the contract, and either a single date or a graded timeline should be provided.

- Interest: The formula for calculation of interest and the payment mode should be given thereunder.

Drafting of a 364-Day Credit Agreement

The following guidelines need to be followed for the drafting of a 364-day credit agreement:

- The purpose needs to be broad but, at the same time include certain specifics. For example, instead of outlining what general corporate purposes, one may put a broad heading of general corporate purposes.

- The interest rate needs to be mentioned along with its calculation formula. Whether it is fixed or floating also needs to be mentioned.

- Conditions for utilization should be negotiated before one includes the same in the contract.

- The timeline for repayment should be included.

- All the complex terms used should be defined.

- The fact that no security is being given in lieu should be mentioned.

- As this is an unsecured agreement, all the possible available remedies should be listed out.

- Risk-preventing clauses such as indemnity and limitation of liability should also be included.

Benefits of a 364-Day Credit Agreement

- Such a contract helps the borrower to receive funding in a short time.

- It provides flexibility in meeting financial obligations.

- Repayment terms may be flexible, which makes it easier for the borrower to repay the loan.

- It makes the cash readily available at the time of one’s need.

- Clarity of purpose for which such a loan is to be used.

Cons of a 364-Day Credit Agreement

Cons of a revolving credit agreement are:

- Having a revolving credit may tempt the borrower to over-spend.

- The flexibility in repayment options may cause the borrower to become lax in the repayment.

- Being unsecured in nature, such a contract may need to be extensively litigated if any dispute arises.

- If the interest rate is floating and not fixed, then this may prove to be a cause for concern.

A revolving credit agreement makes ready cash available at the time of need. It ensures that funds are always available, and hence corporates are tempted to enter into such contracts. However, the interest rates, repayment schedules, and other such risk factors should be assessed before one decides to enter into such a contract in order to raise credit. Being an unsecured loan, it may be difficult for the creditor to get back their money, in the event of a dispute. This warrants the contract to have foolproof dispute resolution clauses and remedies.

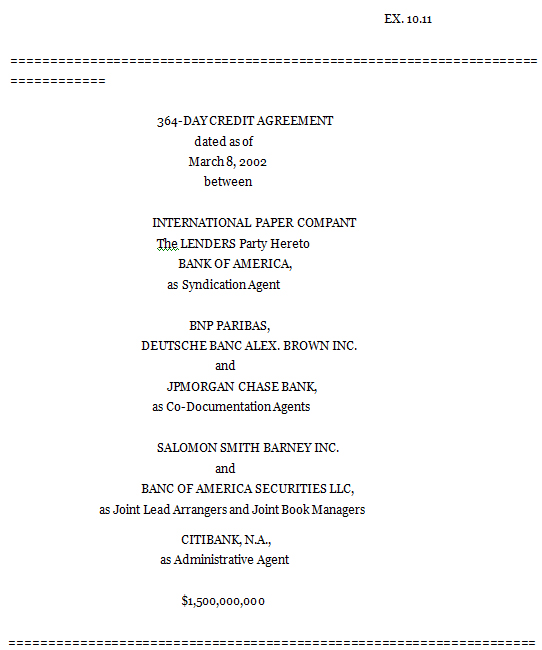

Sample for 364-Day Credit Agreement

A sample of the agreement can be downloaded from below.

Download this USA Attorney made original Agreement for only $9.99

By clicking the button below, I agree with the Terms & Conditions.